Introduction

Have you ever walked into a store and wondered why a gallon of milk costs $4.00? Why not $1.00? Or why not $50.00?

It often feels like prices are just set in stone by some mysterious authority. Still, they are actually the result of a silent, constant negotiation happening every single second of the day. This negotiation determines everything from the price of your morning coffee to the salary you earn at your job.

In this post, we are going to explore the concept of Equilibrium. By the end, you’ll understand the invisible "sweet spot" where the economy finds its balance—and why that matters for your bank account.

The Great Tug-of-War: Finding the Balance

To understand equilibrium, imagine a giant game of Tug-of-War.

On one side of the rope, you have Buyers (that's you). You want to buy things as cheaply as possible.

On the other side of the rope, you have Sellers (businesses). They want to sell things at the highest possible price.

If the Sellers pull too hard and set the price too high, buyers walk away. The rope goes slack.

If the Buyers pull too hard and demand a price that is too low, sellers can't make a profit and stop producing. The rope goes slack again.

Economic Equilibrium is the moment when the tension on the rope is perfectly balanced. The Federal Reserve describes this as the point where there is no shortage and no surplus—the exact price where the number of products sellers want to sell matches the number of products buyers want to buy.

Key Components: How the Balance Happens

To find that sweet spot, two major forces have to work together.

1. The Force of Demand (Buyers)

Demand is the quantity of a product consumers desire at a given price. As a rule, lower prices increase demand (everyone loves a good deal!), while higher prices reduce demand. For a deeper dive into these mechanics, consider reading Principles of Economics.

2. The Force of Supply (Sellers)

Supply, the quantity of a product that businesses are prepared to manufacture, is directly influenced by price. When a product's price increases, companies have a greater incentive to produce more to achieve higher profits. According to the International Monetary Fund, this relationship is the core engine of the market economy.

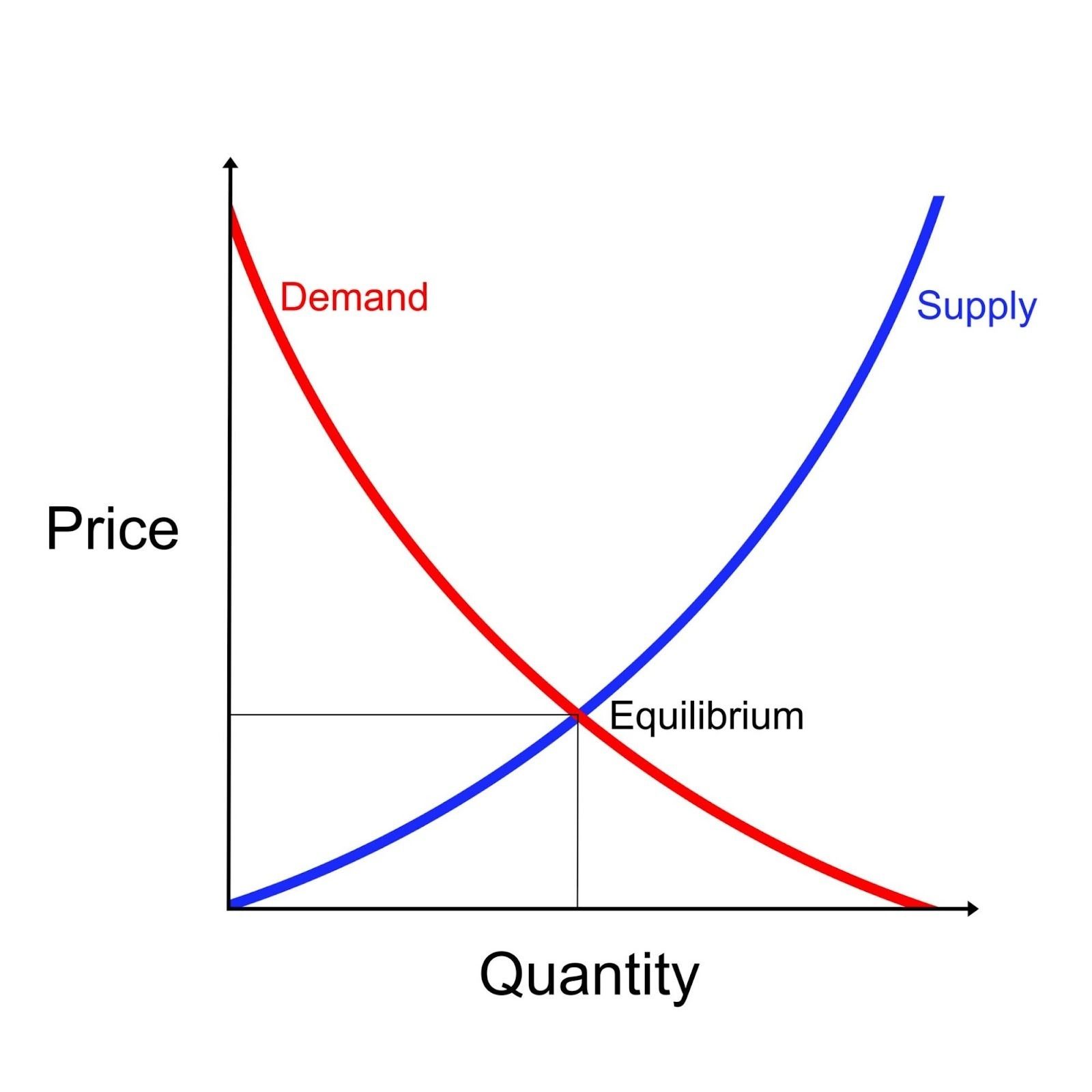

3. The Intersection

When you graph these two forces, they form an 'X'. The point where they cross is the Equilibrium. At this point, the market is "cleared," meaning everybody who wants to buy at that price can, and everyone who wants to sell at that price can.

Why This Matters to You

You might be thinking, "Okay, cool theory, but how does this help me pay my bills?" Understanding equilibrium helps you predict financial trends and make smarter decisions.

1. It Explains Your Salary

Your paycheck isn't random; it's the equilibrium price for your skills. If you have a rare skill (low supply) that companies really need (high demand), your "price" (salary) goes up.

What this means for you: To increase your income, you need to acquire skills that are in high demand but low supply. Such scarcity gives you leverage to negotiate a higher equilibrium wage. To truly master this concept, check out Naked Economics: Undressing the Dismal Science

2. It Explains Housing Prices

When you see house prices skyrocket, it’s usually because equilibrium has been disturbed. If more people want to buy homes than there are homes for sale, the price must rise until some buyers drop out, restoring the balance.

What this means for you: If you are buying a home in a "seller's market" (high demand, low supply), you will likely pay a premium. Sometimes, delaying a purchase until the supply increases (e.g., the construction of more houses) may result in cost savings.

3. It Helps You Spot Deals

Sometimes, stores miscalculate. They might stock too many winter coats (Surplus). To get back to equilibrium, they have to lower the price to get you to buy them. We call that adjustment a "clearance sale."

What this means for you: You can save money by shopping for seasonal items when the market is in surplus—like buying winter coats in April.

Common Questions (FAQ)

Is Equilibrium permanent?

No! It is constantly moving. Imagine that Tug-of-War game again; if a sudden rainstorm hits (like a pandemic or a technology breakthrough), one side slips, and the rope moves. The market is constantly adjusting to find a new equilibrium.

Can the government change the equilibrium?

Yes. Sometimes the government sets a Price Ceiling (a maximum price, such as rent control) or a Price Floor (a minimum price, such as the minimum wage). While people do these with good intentions, they can sometimes create shortages or surpluses by preventing the market from naturally finding its balance.

Your Takeaway

The next time you see a price tag, remember: it’s not just a number. It is a signal. It tells you exactly where the battle between buyers and sellers has settled for the moment.

By understanding Equilibrium, you stop seeing the economy as a confusing mess and start seeing it as a logical system. Whether you are asking for a raise, buying a house, or shopping for groceries, you now know that price is just the point where supply shakes hands with demand.

Use this knowledge to buy when the balance is in your favor!

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.